You may remember some time ago I blogged (Be Smart Not Right!) on the handling of the Kashflow PR attacks on Sage, and that I felt that perhaps the Sage guys were missing a trick in getting too "formal" with Duane.

Well, I take my hat off to them and in particular to Paul Stobart, UK MD of Sage, by cutting through the BS and communicating directly and in real time with their channel partners and customers through Twitter yesterday.

There are those that might claim that Sage's partner base is too large, and indeed there may be even those over the years that might have wanted to take the knife to cut it down to a more manageable size. Right or wrong, this sort of initiative allows the company to directly interact with the more active and lively parts of the channel, which is what Sage clearly needs to do in order to stay at the forefront as a lead vendor in the SME market.

Thursday, July 23, 2009

Tuesday, July 21, 2009

REAL US Unemployment

I am sure many of you have seen and/or heard analyses that argue that the US unemployment rate is really higher than reported, due to a number of factors. Here are a few bullets that use facts (that I got from WSJ) to put things in perspective:

Where are we today:

- Current rate = 9.5% unemployment

- 7.2 million jobs lost since the start of the recession

- The cumulative job losses over the last six months have been greater than for any other half year period since World War II

- The job losses are also now equal to the net job gains over the previous nine years, making this the only recession since the Great Depression to wipe out all job growth from the previous expansion

That is bad. but it may be worse than it sounds. Now, let's increase the 9.5% to a more "real" number:

- 1.4 million people wanted or were available for work in the last 12 months but were not counted, since they may not have sent out a resume in the past 4 weeks - this adds about 0.8%.

- The number of workers taking part-time jobs instead of their sought after full time jobs has doubled to about nine million, or 5.8% of the work force. Taking 50% of this, adds 2.9%.

- The average work week in the private sector (~80% of the work force) is now 33 hours. Almost one hour less than prior to the recession. (This is driven by things like production capacity in the US is dropped to an average of 65%.) This is tantemount to 3.3 million fewer employees - an additional (quasi) 2.2% for unemployment.

- Alltogether, one could conceptually add about 6% to the 9.5% number - bringing it to well over 15%!!

So are there signs of improvement? Not looking good. And this is based on the uniqueness of this recession.

- First of all, the average length of official unemployment increased to 24.5 weeks, the longest since government began tracking this data in 1948.

- Second, the number of long-term unemployed (i.e., for 27 weeks or more) has now jumped to 4.4 million, an all-time high.

- Third, unemployment has doubled to 9.5% from 4.8% in only 16 months; very fast.

Why has all this happened? What is so unique?

I believe that in this recession, the employee cutbacks are not simply cutbacks. Normally, companies do cutbacks, and then rehire once the economy improves. The fire based on decisions taken earlier in the business cycle - to ensure earnings targets, etc.

But (if and) when economic activity picks up, (as quoted from the WSJ - ) "many unemployed workers looking for jobs once the recovery begins will discover that jobs as good as the ones they lost are almost impossible to find because many layoffs have been permanent. Instead of shrinking operations, companies have shut down whole business units or made sweeping structural changes in the way they conduct business."

Just look at two huge sectors and employers in the US - the auto sector and the financial sector. The US auto market is forever slashed across the sector's value chain, while the financial services companies have exited many parts of the world of finance - never to return.

So it seems that Americans and many other parts of the world have to rethink how to rebuild.

Monday, July 20, 2009

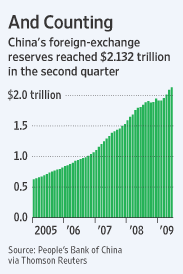

China - What are they saving up for?

I remember when I was a kid, I used to get a weekly allowance. I used to spend it as I wished. But when there was a specific reason, I would save my money towards the larger purchase. Like Nike Air Jordans, roller blades, etc.

So my question is simple. What is China saving up for? I fear the answer...

Subscribe to:

Comments (Atom)